Unlock Your Wealth Potential Through

Real Estate Investments

We are pleased to offer this 253 unit, private investment opportunity in the fastest growing county in Kansas City, Missouri.

Unlock Your Wealth Potential Through

Real Estate Investments

We are pleased to offer this 253 unit, private investment opportunity in the fastest growing county in Kansas City, Missouri.

136%

Projected Total Return

2.36x

Projected Equity Multiple

9%

Preferred Return

Investor Webinar

Thursday, July 21st - 7PM CDT

Hosted By: Anthem Capital

Investor Webinar

Join us for our webinar in which we will cover our business plan on how we can unlock this investments full market potential and do a live Q&A with investors just like you.

The Investment Opportunity

Projected Total Return

136%

Preferred Return

9%

Projected Equity Multiple

2.36X

Projected IRR

20%

Projected Average

Annualized Return

27%

Minimum Investment

$50k

506(b) OFFERING

The Property

Anthem Capital is pleased to present the opportunity to invest in Hunters Glen Apartments. Hunters Glen Apartments Kansas City is a 253-unit, 1975 asset located in Platte County, Missouri. Platte County is the fastest growing county in Missouri and is experiencing an 8.1% population growth within a 1-mile radius of Hunters Glen.

The location checks all the boxes. It has an award-winning school district, an affluent demographic, and is near major employment opportunities.

This property has been locally owned and well maintained for the last 30 years. The previous owners have invested $5M towards exterior renovations over the last 5 years, but have not upgraded the interiors of the units. Our business plan will look to maximize the return on your investment by focusing on upgrading the interiors to drive corresponding rent growth.

Watch This Video To The End

Image Gallery

Highlights

Property

- 253 unit class B multifamily property located in the fastest growing county in Kansas City, Missouri

- Built in 1975 and maintained by the same owner-operator for over 30 years

- Physical Occupancy of 97%

- 11 residential buildings spread across 18 acres, gives residents a more quiet setting while still being in the heart of Platte County

Attractive Location

- An award winning school district

- An affluent demographic base with median household incomes of $72.6k within a 1 mile radius

- Close proximity to Kansas City’s leading employment hubs with healthcare, professional/tech services, and retail trade, comprising the top three sectors.

- Easy access to destination retailers like Zona Rosa, Edgewood Farms, Shops at Boardwalk and Tiffany Springs Market Center.

- Poised for even more economic growth thanks to the new, $1.5B Kansas City airport that is slated to open in 2023 and is only a 10 minute drive from Hunters Glen.

Amenities

- 487 off-street parking spots

- Clubhouse with a swimming pool

- Fitness center with locker rooms and a sauna.

- Laundry facilities in each building.

- Multiple picnic areas and grilling stations

- A 9 acre, city park that provides hiking trails and playgrounds for the residents of Hunters Glen.

- Private patios or balconies for most units

Value-Add Acquisition

- Upgrade the interiors of 150 of the units

- Burn off loss to lease to keep pace with surrounding market rental comps

- Implement a water savings program to save up to 35% in water costs.

- Unlock other revenue streams, like pet rent and utility bill back.

- Utilize professional property management to optimize expenses and raise rents

Conservative Underwriting

- Cumulative rent growth for the 5 years is consecutively underwritten at 30% below CoStar rent growth forecast.

- Conservative exit (revision) CAP rate 5.5% is 190bps above actual T3 CAP rate.

- Economic vacancy underwritten for 25% in year 1 and 17% in year 2 while current physical occupancy is 99.6%.

- Organic pro forma rents underwritten at or below the low end of what comps in the area are receiving for rent.

- Projected other income increase with utility bill back applied over two years’ time.

*Values will be reflected in final appraisal.

The Sponsor Team

Iven Vian

(Co-Sponsor)

Cell: 405-757-9897

iven@anthemcp.com

Tariq Sattar

(Co-Sponsor)

Cell: 405-314-5072

tariq@anthemcp.com

Shafayet Hossain

(Co-Sponsor)

Cell: 913‐298‐1144

shafayet@higequity.net

Tazrina Hossain

(Co-Sponsor)

Cell: 913‐732‐0567

tazrina@higequity.net

Amy Cheng-Whittaker

(Co-Sponsor)

Cell: 417-323-2372

Amy@omeyestars.com

Tazrina Hossain

(Co-Sponsor)

Cell: 417-501-9191

Cory@omeyestars.com

Experienced Sponsorship Team

- Cumulative rent growth for the 5 years is consecutively underwritten at 30% below CoStar rent growth forecast.

- Conservative exit (revision) CAP rate 5.5% is 190bps above actual T3 CAP rate.

- Economic vacancy underwritten for 25% in year 1 and 17% in year 2 while current physical occupancy is 99.6%.

- Organic pro forma rents underwritten at or below the low end of what comps in the area are receiving for rent.

- Projected other income increase with utility bill back applied over two years’ time.

DO YOU WANT TO FOLLOW ALONG?

Download the Investor Package PDF

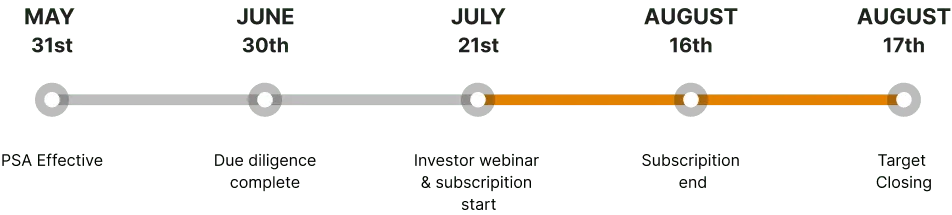

Acquisition Timeline

DISCLAIMER NOTICE

This is a 506B investment opportunity. If you are receiving this email, you are in our investor database and have a pre-existing and substantive relationship with one of the sponsors of this project. If you received this by accident then please contact invest@anthemcp.com. This Business Plan contains privileged and confidential information and unauthorized use of this information in any manner is strictly prohibited. If you are not the intended recipient, please notify the sender immediately. Without prior permission from Hunters Glen Apts LLC, no person accepting this document shall release or reproduce (in whole or in part) this document, discuss any information contained herein, make representations or use such information for any purpose other than to evaluate the company’s business plans as provided herein. By accepting this document, the recipient agrees to keep confidential all information contained herein or made available in connection with any further investigation. Upon request, the recipient will promptly return to the company all materials received from the Sponsors and their representatives (including this document) without retaining copies thereof.

This Business Plan is for informational purposes and not intended to be a general solicitation or a securities offering of any kind. Prior to making any decision to contribute capital, all investors must review and execute all private offering documents.

Potential investors and other readers are cautioned that these forward looking statements are predictions only based on current information, assumptions and expectations that are inherently subject to risks and uncertainties that could cause future events or results to differ materially from those set forth or implied by such forward looking statements. These forward-looking statements can be identified by the use of forward-looking terminology, such as “may,” “will,” “seek,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. These forward-looking statements are only made as of the date of this Business Plan and Sponsors undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

The information contained herein is from sources believed to be reliable, however no representation by Sponsors, either expressed or implied, is made as to the accuracy of any information on this property and all investors should conduct their own research to determine the accuracy of any statements made. An investment in Hunters Glen Apts LLC will be a speculative investment and subject to significant risks and therefore investors are encouraged to consult with their personal legal and tax advisors. Neither the Sponsors, nor their representatives, officers, employees, affiliates, sub-contractor or vendors provide tax, legal or investment advice. Nothing in this document is intended to be or should be construed as such advice.

© Anthem Capital. All rights reserved